- Products›

- Amazon Web Services Support›

- Fapiao Information Guide

Digitalized E-Fapiao Information Guide

Digitalized E-Fapiao FAQ

Open allA: A Digitalized E-Fapiao is a new type of fapiao with the same legal effect as a paper fapiao. Digitalized E-Fapiao is not in paper format, does not require any tax control equipment such as tax disk, and does not need to be physically purchased. Digitalized E-Fapiao fully digitizes the information of paper fapiao. It integrates multiple types of fapiaos into a single type of electronic fapiao through label management, and implements the unified national code assignment. The system automatically grants the quota of fapiao, and establishes a tax digital account to realize the automatic flow of fapiao delivery and data collection. To learn more about Digitalized E-Fapiao, see the following:

A: A Digitalized E-Fapiao simplifies or removes some information and columns included in a paper fapiao. For example, it removes address, telephone number, bank name, and bank account information of both the buyer and seller, only keeping their name and tax registration number. It also replaces the original fapiao code and fapiao number with only the 20-digit fapiao number. The Payee and Reviewer columns are removed (the Issuer column is retained). The "seller (seal)" column is also removed because stamping a Digitalized E-Fapiao is not required. If you have special requirements for the information displayed in your Digitalized E-Fapiao, sign in to the console (https://console.amazonaws.cn/support/home) and open a case.

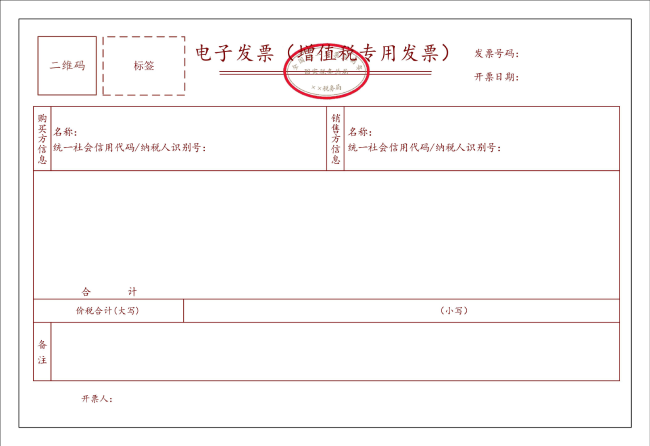

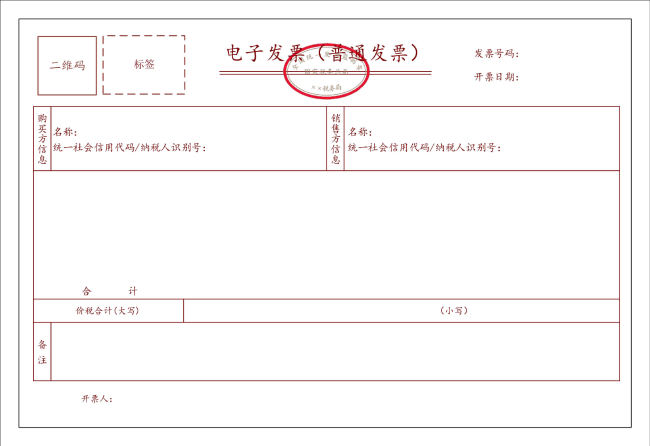

Digitalized E-Fapiao format:

- Digitalized E-Fapiao (Special VAT Fapiao)

- Digitalized E-Fapiao (General Fapiao)

A: You can verify a Digitalized E-Fapiao using the national VAT invoice verification platform (https://inv-veri.chinatax.gov.cn) or through the tax digital account on the electronic invoice service platform.

A: We will send Digitalized E-Fapiaos to your Amazon Web Services account email address and any email address in your alternate billing contacts. If you need to change the email address for receiving Digitalized E-Fapiao, sign in to the console (https://console.amazonaws.cn/support/home) and open a case.

A: The Digitalized E-Fapiao that we will send to you will be in both XML and PDF formats by default. If you need the Digitalized E-Fapiao in OFD format, sign in to the console (https://console.amazonaws.cn/support/home) and open a case.

A: You can print the Digitalized E-Fapiao according to your company's requirements. We do not provide a printed version of the Digitalized E-Fapiao separately.

A: Yes. The legal effect and basic use of Digitalized E-Fapiao are the same as those of the paper fapiao. Although a Digitalized E-Fapiao that you print out will not have our fapiao seal, it is still a valid tax invoice. Make sure you keep the electronic form of the Digitalized E-Fapiao.

A: No. We will issue you general Digitalized E-Fapiao or special Digitalized E-Fapiao based on the fapiao type you specified in the Fapiao Management page.

A: No. We do not accept requests to switch from receiving Digitalized E-Fapiao to receiving paper fapiao.

A: We will not issue paper fapiao to customers after transiting to Digitalized E-Fapiao. Ningxia Western Cloud Data Technology Co., Ltd. ("NWCD"), the operator of Amazon Web Services China (Ningxia) Region ("Ningxia Region"), has fully enabled Digitalized E-Fapiao starting from February 2024. NWCD no longer issues paper fapiao since then.

Beijing Sinnet Technology Co., Ltd. ("Sinnet"), the operator of Amazon Web Services China (Beijing) Region ("Beijing Region"), has joined the pilot program for Digitalized E-Fapiao. Sinnet will start to issuing Digitalized E-Fapiao from April 2024 and will no longer issue paper fapiao.