我们使用机器学习技术将英文博客翻译为简体中文。您可以点击导航栏中的“中文(简体)”切换到英文版本。

区块链和活动票务的未来

购买音乐会、戏剧和其他活动门票的人们普遍感到沮丧的是,每张门票都要收取多笔费用。费用通常以看似难以理解的方式变化,这使得最终成本变得不可预测。在门票的整个生命周期中,多个中介机构可能会增加成本并收取收入,而活动的原始创作者和贡献者却没有金钱上的好处。此外,机器人渗透到当前的系统中。这些机器人从主要卖家那里购买门票,然后在二级市场上以更高的价格出售。在幕后,由于缺乏协作,组织之间浪费了大量的重复精力。

区块链及其支持的数字资产技术可以通过优化转售流程、促进卖家之间的协作竞争以及为消费者提供更全面的体验,使人们能够以更低、更透明的成本参加活动。

在这篇文章中,我们讨论了基于区块链的票务系统如何使消费者受益匪浅。我们设计了一个假设系统,同时强调了设计此类系统时需要考虑的因素。

以不可替代代币 (NFT) 的形式发行活动门票

不可替代的代币(NFT)代表存储在区块链上的独特资产。不可替代性意味着物品或资产不能与其他代币互换,因为其独特属性会影响其价值。例如,独特的棒球卡是不可替代的,因为根据版本号、设计、玩家和稀有度,这些卡片具有不同的值。将活动门票创建为 NFT 可以保证门票是独一无二的,不可复制,并且可以根据其独特属性提供对插件的精细访问。NFT与区块链的交互也可以通过使用智能合约进行编程,并且每一次交互都永远存在于区块链上。铸币过程创建了 NFT,其代币标识符通过智能合约映射到所有者。当前所有者可以通过调用智能合约中的转移函数将 NFT 转让给新所有者,然后智能合约将其重新分配给新的所有者。所有这些交易都可以在区块链上永久验证,因为区块链是一个永久的账本。可编程性还允许外部世界的行为者,例如所有者、卖家、创作者和发起人,对 NFT 进行更复杂的使用和互动。

这些特征对行业具有广泛的影响,例如:

- 最高价格

即使在转售期间,也可以设置最高门票价格。此功能大大降低了以面值购买尽可能多的门票并在二级市场上转售以获得最大利润的动机。门票从主要卖家处售罄,只能从次级中介那里以更高的价格出售,而后者反过来又会进一步削减门票,这种问题发生的可能性要小得多。

- 艺人转售收入

负责主办赛事的艺术家、运动员、创作者和贡献者现在可以从特许权使用费形式的转售中受益。通过在智能合约中对其进行编程,他们可以从每笔销售中提取一定比例。

- 数字收藏品

NFT 门票可以在活动结束后进行收藏和转售,就像在实体门票时代一样。NFT 在美学上也可以令人愉悦,就像一件可收藏的艺术品一样。

利用共同的参考框架与多个组织进行合作竞争

区块链的使用还允许单一的、非孤立的、高度可用的真相来源和庞大的互联系统。这使通常不合作的组织有机会通过构建和利用彼此的可互操作服务来进行协作。组织之间的这种额外合作使他们能够为消费者提供更全面、更全面的体验。这形成了公司 之间的 合作竞争 ,因为没有一个垄断者拥有和获得门票。这允许其他组织构建服务并引用相同的通用票证。以下是一个假设的例子:艺术家可能会发现,根据门票交易,与商品销售商、视频内容创作者以及提供食物和饮料的场所进行更顺畅的合作会更容易。可以为参加一定数量节目的忠实粉丝制定奖励计划。该系统可以从艺术家的赞助商那里向消费者提供免费或打折的商品。区块链更容易实现这些目标,因为各方之间的合作是建立在区块链本质上的。以前的模型让公司保留自己的数据,而跨组织协作不一定是常态。

此外,使用区块链购买活动门票可以简化转售流程,使人们无需中介即可进行交易。转售门票时,卖家可以通过这个中立的区块链系统直接将门票转让给买家。相比之下,当前的集中式模式要求主要的门票销售平台将门票存放在他们的系统中。在这种当前状态下进行转售要求卖方将门票从主门票销售平台转让给买家。如果买家在主门票销售平台上没有账户,则买家必须先创建一个账户。然后,卖方必须确认转让已在二级门票销售平台上完成。从二级销售平台购买门票时,当前的流程需要多个账户,因为主销售平台在其整个生命周期中都存放门票。本质上,主要销售平台拥有门票,每笔交易都必须在其系统内进行。区块链使消费者能够进行自助交易,同时减少中介机构。

目前,由于不同系统之间缺乏共同的参考框架,因此很难提供这些体验。由于链上数据以相同的开放格式存在,因此可以最大限度地减少协作中的摩擦。您可以自助提取数据,也可以触发编程事件。参与区块链可以增加和简化合作机会,同时提供更丰富的体验和产品,让健康的竞争蓬勃发展。

服务费价格承诺

由于智能合约是不可变的,因此公司可以承诺收取透明、一致的服务费。公司可以对费用进行编程,使其直接与运营成本和通货膨胀保持一致,而不是收取静态的固定费用。智能合约还可以根据需求等条件启用动态费用。在区块链活动票务系统中,费用可以更加可预测和透明。

区块链注意事项

为了构建一个利用区块链优势的活动票务应用程序,需要考虑一些因素。我们将在以下段落中探讨每个问题。

- 我们应该使用公共链还是私有链?

- 我们如何解决成本高昂且不可预测的汽油费?

- 我们应该使用哪种汇总类型?

- 哪些数据应该存在于链上,哪些应该存在于链下?

公共链

使用公共区块链的选择归结为无需许可的访问和去中心化。在去中心化、深度连接的环境中拥有一个实体可以提供普遍性、访问权限和验证。该用例的公共区块链解决方案将使用以太坊,其节点由

当 NFT 存在于以太坊世界中时,根据

在这个庞大的深度关联环境中,交易是公开可见的,因此可以更容易地根据链上行为来确定某人是否是诚实的参与者。该系统可以自动拒绝向表现出类似机器人行为的用户购票。与现有的集中式主票务系统相比,私有链不提供可以带来显著优势的开放接入。

第 2 层可提高成本效益

由于网络拥塞,开发人员可能会发现在的以太坊

例如,流行的二级汇总解决方案Arbitrum的平均交易费用为0.20美元,而以太坊的平均交易费用约为4美元。还有一项

使用 L2 网络确实有一些缺点。基于 L2 解决方案构建的 Dapp 无法直接与 L1 解决方案交互,从而导致可组合性丧失。目前正在努力提高二级互操作性,以最大限度地减少此问题。使用 L2 时,在安全性和去中心化方面也需要权衡取舍。L2 解决方案开发人员具有一定程度的信任,因为他们是更集中的实体。L2 上的交易也不会与 L1 进行实时结算。在交易结算之前,用户不会意识到以太坊的强大安全优势。

选择最好的汇总

两种类型的汇总是

ZK 汇总交易争议机制的结果是更快的吞吐量,同时最大限度地减少了安全权衡。另一方面,乐观汇总没有相同的内置机制。他们假设交易是有效的,而不是使用有效性证明。因此,乐观汇总需要一段质疑期,在此期间,任何人都可以使用欺诈证据对汇总交易结果提出异议。尽管 NFT 所有权转让对消费者来说可能是即时的,但重要的是要承认,争议解决等待时间会带来风险。该系统可能会在几周后使所有权失效,在争议解决完成之前,卖方无法提取资金。目前,我们在本示例中之所以选择乐观汇总 Arbitrum,是因为它能够部署智能合约,并且具有很高的EVM兼容性。开发人员可以在

链上数据与链下数据

由于成千上万的节点、达成共识的要求以及相应的交易成本,在链上存储每条数据并不高效。最好确定哪些数据点可以从去中心化中受益,哪些可以存在于更具成本效益的集中式数据库中。为了从另一个角度探索这个想法,我们可以从文件存储的角度来看待这个问题。

NFT 艺术文件无处不在并以持久的方式呈现非常重要。NFT 艺术将受益于图像文件的去中心化

高级系统设计

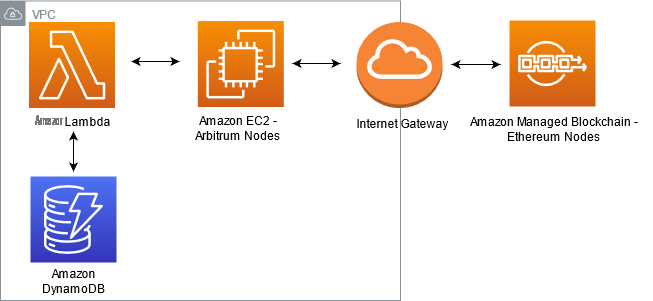

您可以使用

结论

在区块链上创建 NFT 票证可以优化流程,并促进不同组织之间的更多合作。能够在中立的平台上引用相同无处不在的门票,为消费者提供了更好的整体体验。为了使区块链票务系统蓬勃发展,越来越多的艺术家、运动队和其他演艺人员必须选择将门票存储在区块链上的票务销售平台。

借助 Amazon Managed Blockchain,您可以在几分钟之内在主网和公共测试网上创建专用、完全托管的以太坊节点。以太坊持有

这篇文章是一份入门指南,旨在帮助理解其含义以及在设计 NFT 区块链系统时必须考虑的因素。请联系您的客户团队,获取有关设计和实施此类符合您愿景的系统的更多指导。如果您尚未开始 亚马逊云科技 之旅,请开设一个至少具有业务支持级别的账户,以获取与您的用例相关的架构指导。

作者简介

Kevin San Juan

是一名高级技术客户经理,也是 亚马逊云科技 区块链深度领域技术领域社区的一员。他正在亚马逊云科技上共同撰写一本关于区块链的书,并在有关区块链技术的活动上发表演讲。他大部分时间都在被恶毒但又可爱的霸王龙(他3岁的女儿)追赶。

Kevin San Juan

是一名高级技术客户经理,也是 亚马逊云科技 区块链深度领域技术领域社区的一员。他正在亚马逊云科技上共同撰写一本关于区块链的书,并在有关区块链技术的活动上发表演讲。他大部分时间都在被恶毒但又可爱的霸王龙(他3岁的女儿)追赶。

*前述特定亚马逊云科技生成式人工智能相关的服务仅在亚马逊云科技海外区域可用,亚马逊云科技中国仅为帮助您发展海外业务和/或了解行业前沿技术选择推荐该服务。